The A Self-Directed IRA is an individual retirement account that gives you a wider range of investment options than a standard IRA custodian allows. Most IRA custodians are banks or stock brokers. They only allow the investment vehicles that provide themselves a financial benefit. A self-directed IRA, on the other hand, has a custodian that allows you to invest your IRA in the much broader set of options allowed under the IRS code.

Many IRA custodians only allow investing in stocks, bonds, mutual funds and CDs. A self-directed IRA custodian allows those types of investments in addition to real estate, notes, private placements, tax lien certificates and much more.Many people will benefit from the features of a self directed IRA.

There are some advantage to having that structure own one or more LLCs, such as asset protection and investment flexibility. This arrangement is especially for those who truly want to have control of their Investment portfolio. Such investors may substantially increase their rate of return, reduce fees, and give them the ability to make fast investment decisions.

This is nothing new. Investors have had the ability to self-direct their investment funds into their choice of arenas and reap tax-free profits since 1974. In the last 10 years or so, the self-directed investing tool received the ultimate in flexibility, that of owning and managing a Limited Liability Company.

* IRA owns 100% of LLC

**Just like the IRA can invest in Apple stock in exchange for the IRA owning shares of Apple stock, the IRA can also invest in a privately held LLC in exchange for membership interest in the LLC.

*** By default, the owner of the LLC is responsible for the taxes. Since the owner of the LLC is an IRA, profits grow tax-free.

What To Do

- Open a new self directed IRA and have your IRA Limited Liability Company professionally organized

- Roll all existing funds into your new retirement account

- Form a new LLC that the new IRa owns (that has a specially drafted compliant operating agreement)

- Move all IRA funds into your LLC’s bank account via IRA custodian

- Issue LLC membership interest certificate to your IRA

With the above format you are free to invest your retirement funds. It is as easy as signing a check. This opens many doors to investment opportunities, such as real estate, gold, and privately held companies. All that the IRS/DOL requires is that your LLC conforms to all of their regulations. Plus, you need to make approved investments. For example, you can’t legally buy a vacation home through your IRA LLC and vacation in it. There is no self-dealing. For example, you can’t legally buy a home or other asset from yourself that you already own. Although there are exceptions, these rules are for legitimate investments. See IRS guidelines.

Use the number on this page or the inquiry form to go over your needs with a consultant.

What Can an IRA LLC Do?

- Make quick investment decisions: Buying foreclosed real estate properties is a classic example of checkbook speed investing. You can take financial action without a custodian nixing the process or charging exorbitant fees.

- Really, legitimately diversify your investments: You can implement your retirement funds for a multitude of tax-free profit opportunities. For example, your LLC can make short-term or long-term loans on real estate, automobiles or businesses, and charge higher rates than traditional lending institutions.

- Save money and have closer control: You can buy rental property, then screen your own tenants and manage it yourself, avoiding property management costs.

You are free to write a check from your LLC bank account into the investment of your choice without custodian approval, review fees or transaction charges resulting in the most flexible retirement investing tool with more opportunity, control, security, and quite frequently – greater growth potential.

Protect an IRA from Divorce

Many people are concerned about protecting their IRAs from divorce. When we set up an asset protection plan for someone contemplating divorce, this is what we do. First we set up a self-directed IRA. Then the client moves assets from the current plan to the self-directed IRA custodian. We set up a Wyoming LLC that the IRA owns. The client asks the self-directed IRA custodian to invest the IRA proceeds into the Wyoming LLC. The IRS allows one to invest in a privately held company. Most custodians don’t allow such transactions because they cannot charge you stock brokerage commissions for doing so.

Next, we set up an offshore trust with two parts. Part A is for non-retirement assets. Part B is for retirement assets. The A portion owns an offshore LLC. The B portion owns another offshore LLC. The client, as the signatory on the Wyoming LLC, wires the funds to the offshore LLC that is in the retirement portion of the trust. The IRA is the beneficiary of the retirement portion of the trust. When a legal attack strikes, our offshore law firm steps into protect the assets. The client’s local courts do not have jurisdiction over the offshore law firm. Thus, the assets remain safe and secure. The assets remain under the retirement umbrella, thus the tax benefits remain.

Here is a text diagram of the process of protecting an IRA from a divorce. Funds to from current IRA custodian.—-> To Self-Directed custodian. —–> You ask the Self-Directed IRA custodian to invest the funds into a privately held Wyoming LLC that your IRA will own (Self-Directed custodian will not wire offshore). —–> You, as the signatory on the Wyoming LLC wire the funds into an offshore account held by a Nevis LLC. The Nevis LLC is that the retirement portion of your offshore trust. —->You, in turn, can invest the funds as you wish within the Nevis LLC’s bank account.

What to Do

The mechanics of this are actually quite simple. You self direct your current IRA into investing in a privately held LLC. Your IRA owns one hundred percent interest of a company that you manage that invests your retirement funds. There are few limitations and almost all prohibited transactions involve commingling funds with a related party; a related party being you and your immediate family. See the IRS rules for exact definitions. Nearly all arms length investments will be legitimate and there are number of legal exceptions that can be made. Speak to a licensed tax or investment advisor about your situation for more detail. In addition, your self-directed IRA custodian can help guide you.

Setting It Up

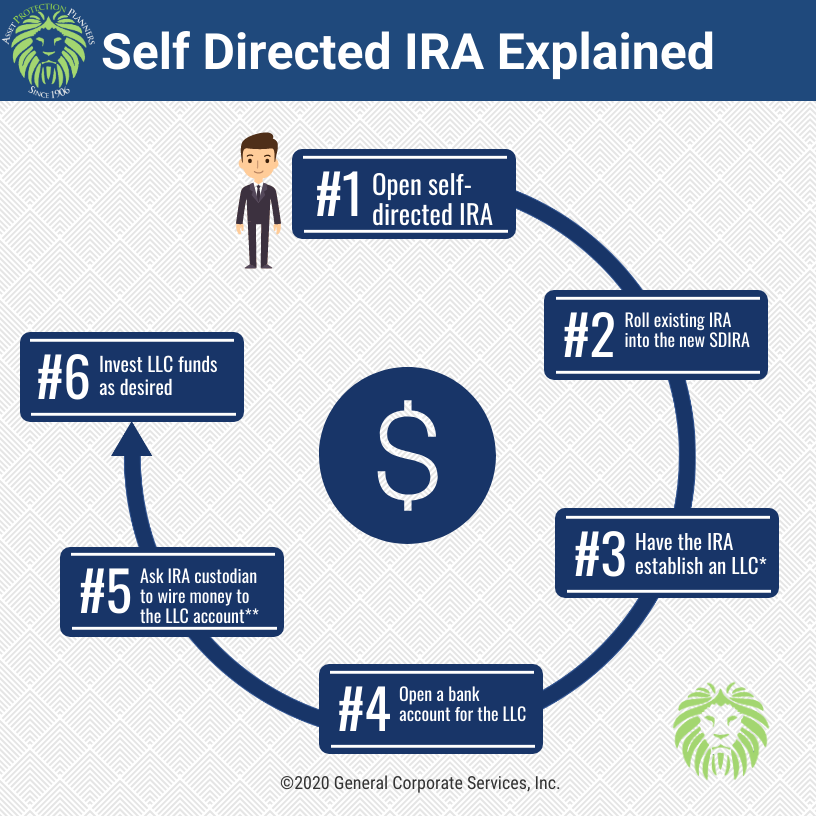

Setting up an IRA LLC is a several fold transaction; first you need a self-directed IRA. Then you direct your IRA custodian to invest in a newly formed LLC. You open a bank account for the LLC. Finally you fund the IRA LLC. Once you have completed all of this you can begin self directed investing with your retirement account.

It’s critical that you handle all of these items in the proper order. That is, you need to make sure that all of the agreements and formation documents are customized for the IRA. Additionally, the IRA needs to pay for the entire process. If the IRA owner personally pays for any of this, the entire account could be a prohibited transaction. The IRS boundaries on this are definite with severe consequences for falling on the wrong side of the prohibited transaction lines. It’s paramount that an experienced professional lead your process with an attorney or qualified tax advisor’s guidance.

Formation of IRA LLC Includes the Following:

- LLC Name Check and Reservation within your State of Choice

- Preparation and Drafting of your Articles of Incorporation

- Documents Filed with the State you elect

- Document Package Delivered via Priority Mail

- Registered Agent Service

- Essential Corporation Checklist

- Complete Corporate Kit

- Rapid Document Filing

- S-Corporation Election Form

- EIN Tax ID Number

- Entity (Tax) Classification

IRA LLC Business Checking Account

- Assistance with setting up a new business checking account for the newly formed LLC

Funding the IRA LLC Includes the Following Steps:

- Opening a new bank account for the IRA LLC

- Issuing membership interest to your self directed IRA

- Approval of the operating agreement

- Assignment of the LLC manager

- Approval of all documents and contracts

- Transferring IRA funds

NOTE: These formation procedures should not be attempted without professional help.

Call the number on this page or use the inquiry form in order to get help.

A Self Directed IRA LLC is where a self directed IRA purchases, or invests in, a new company and in this case a limited liability company. The Self Directed IRA owns the entire limited liability company, and you the IRA owner, manage the new LLC. This LLC manager’s seat provides checkbook control and opens a whole new range of investment possibility for your retirement funds. You make your IRA account the member (owner) of the LLC and will assign a company manager who can receive compensation for services. The LLC manager will be running day-to-day company activities such as executing contracts, wiring funds and signing checks as directed. It’s very important that you seek the help of an experienced professional about how to setup your LLC and management plan for your IRA.

There are regulations, formalities and rules that need to be followed, particularly in the beginning when first establishing your own self directed IRA LLC. First and foremost, your existing self directed IRA will be purchasing the shares of the LLC, which means your IRA must already be established, then you self-direct your retirement funds into this new LLC.

Many people do not choose to establish their own self directed IRA LLC, they turn to a professional provider of legal document services to prepare and file their formation.

Establishing a Self Directed IRA LLC needs to be done procedurally to avoid future complications. It’s important that your company formation and retirement investment account creation be done in order and in concert with the correct internal company operating agreement amendments. Transactions can be prohibited in the event that the IRA or LLC is not established and structured appropriately. Prohibited transactions are the Achilles tendon of reaping lower fees and tax-free investment profits. If your IRA LLC ever comes under the microscope, it is always best that your organization and formation be correct. The price of IRA LLC service is nominal to avoid complications of this nature.

Transactions are only limited to those benefiting the retirement plan and are not between any disqualified parties. This is loosely defined below, for specifics, see IRS documentation on disqualified parties;

- The IRA owner or the spouse of the owner

- The IRA owner’s immediate family, children, parents, etc

- An entity that is more than 50% owned by a disqualified person

- A 10% owner, officer, director or employee an entity owned by a disqualified person

- A fiduciary of the IRA

- Anyone that provides services to the IRA

Below is a list of prohibited transactions and other things you can’t do with a self directed IRA LLC:

- Invest your retirement funds into the home you live in now

- Collateralize loans using retirement assets

- Selling personal property to the IRA

- Loaning money to disqualified persons

- Paying yourself fees

- Buying collectibles

- Purchasing life insurance

There’s never a need to make a prohibited transaction with the limitless investment opportunity that self directed IRA LLCs provide. With checkbook control over your retirement funds, the self directed IRA LLC is the superior retirement fund vehicle for anybody who wants the ultimate in diversity.

Real Estate is a big deal with retirement fund investment and an IRA LLC. You are able to make quick decisions like act on short sales and can accumulate profits for the benefit of the retirement fund tax-free.

How It Is Used

Here you can walk through an example on how an IRA LLC can be used for a higher rate of growth of retirement funds. How to use an IRA LLC.

You have $150,000 in an IRA account and decide that you want to invest those funds into real estate that you acquire through foreclosure auctions. So, you create an LLC with an operating agreement listing the sole member as your IRA account. Next, you will set up a bank account for the LLC and instruct your IRA custodian to wire the $150,000 in the LLC bank account.

With your properly organized, formed and funded IRA LLC, you can jump right in and scoop up those foreclosure sales. You spend $120,000 and acquire four homes, all of which will be purchased and titled to the LLC that is owned by your IRA. You rent each property for a few years and all of the expenses, taxes, insurance and maintenance are paid for by the company using the LLC bank account. Income from rent goes directly to the LLC. Since the LLC is owned by the IRA, the profits are tax free. As tax-free profits come in, the LLC that is inside of your IRA can buy more real estate, gold, stock or other assets to increase diversification in the retirement portfolio.

If each of your rental property nets $500 in cash flow would mean 16% increase in just cash flow. When you are ready to sell the homes, you will liquidate the holdings and your IRA can earn more tax-free cash. You sell your homes for $200,000 which is transferred directly to the LLC bank account. Your initial $150,000 has grown to $272,000.

General Rules of Thumb for IRA LLC Owners

How to avoid prohibited transactions. The IRA LLC owners, family, spouse or linear descendant should never:

- Receive property or distributions from the IRA LLC.

- Benefit or use any property of the IRA.

- Pay any expenses.

- Be paid money from the IRA.

- Engage in any transaction.

- Provide services, compensated or not, to the IRA LLC.

If any non arm’s length investments are being looked at, you should consult with a qualified transaction advisor. There are many ways a transaction can be prohibited, most include mixing activity and expenses with IRA LLC property. If you’re not sure, ask a CPA or other qualified professional. Only engage in activities that you are sure are authorized.

There is a lot for IRA owners to understand when forming the LLC. It is a special purpose investment vehicle which requires careful formation. Your operating agreement, tax status, ownership structure, operating formalities all require special IRA provisions. A trusted organization should establish this for you.

A.K.A. Real Estate IRA

Real Estate IRAs allow retirement account owners to buy real estate with IRA funds, tax-free. You can purchase real estate as fast as writing a check and your investments are not subject to custodian approval or transaction fees. You can make down payments and obtain non-recourse real estate loans to leverage the growth of your investments. Forming an LLC for a Real Estate IRA plan can save and earn you thousands of dollars compared to using a traditional self-directed IRA custodian. This is because you can invest in companies that are not publicly traded, commission-free, such as limited liability companies. Plus you can use the LLCs that you use to purchase real estate and other investments.

The self-directed IRA LLC has become the investment vehicle of choice for purchasing real estate as part of an individual retirement account. Simply creating a self directed IRA LLC allows you to decide where to invest your money. You can control the LLC checkbook. Investments available to you are land deals, apartment buildings, condominium projects, family homes, just to name a few. You can also purchase notes, tax liens, tax deeds, foreign or domestic real estate using your self directed IRA LLC.

With an LLC for your self directed IRA, you can:

- Make immediate purchases – invest in real estate foreclosures, tax liens or make personal loans.

- Be your own property manager (working for the LLC), and save on expenses and maintain complete control over your investment (be sure to obtain licensed tax advice).

- Purchase a retirement home at today’s market value – rent it out until you retire, then take it as a retirement distribution

Experts highly recommend an LLC because of its flexibility and inherit asset protection features. However, if you want to invest your retirement funds into a single property for a very long time period, the additional costs and operating formalities of an IRA LLC are not necessary.

Use qualified expert advisers to guide you through the process – always be certain that transactions are not prohibited. Set up an LLC with an experienced professional. Then, keep the counsel of a licensed attorney and accountant. The attorney can provide you with a document stating whether the transaction is legal or prohibited, The accountant can help make sure you are tax compliant.

Powerful Real Estate IRA Features:

- Only a few IRA custodians will allow direct real estate investments in your IRA. So, your own Real Estate IRA allows you to make decisions and act quickly, thus give you true self-direction.

- Capital gains from real estate sales and profits are tax-deferred in your traditional IRA or tax-free in your Roth IRA like any other investment.

- You can have direct of control of your real estate properties.

- A Real Estate IRA can use IRA funds to make down payments and real estate purchases at checkbook speed.

- Minimal self directed IRA custodian fees since you control the transactions.

- Because the properties are owned in LLCs, assets are protected from lawsuits and separated from other IRA funds and from your personal holdings.